In a striking turn of events, Medallion Financial Corp. and its president, Andrew Murstein, have been fined a combined $4 million for secretly planting fake news articles to boost the company’s stock value. The SEC uncovered a carefully crafted campaign of paid online stories posing as real investor opinion, aiming to mask the firm’s falling fortunes amid Uber and Lyft’s rise. With a federal judge calling the evidence strong, the case exposes how digital storytelling was twisted into a tool of illusion, shaking faith in corporate truth-telling and investor trust.

Table of Contents

ToggleSTORY HIGHLIGHTS:

-

Medallion Financial Corp. fined $3 million; president Andrew Murstein fined $1 million

-

SEC uncovered a covert strategy to publish 50+ fake news articles from 2014 to 2017

-

Posts were disguised as investor opinion, edited by Murstein, and not properly disclosed

-

Scheme coincided with declining value of NYC taxi medallions

-

Judge Lewis A. Kaplan called evidence “more than sufficient” for material misrepresentation

-

PR agent Lawrence Meyers fined $100,000 for involvement

-

Medallion Bank’s value was inflated from $166M to $280M within two quarters

-

Company and executives settle without admitting guilt

-

Stock closed at $9.50 following settlement news

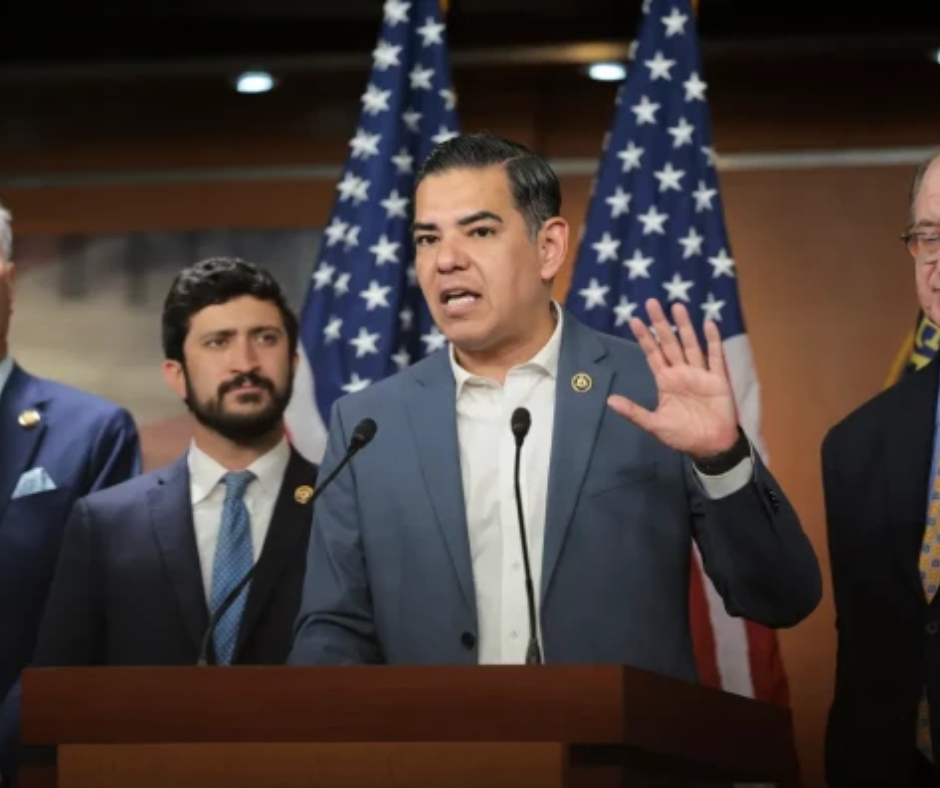

In a twist that blends Wall Street ambition with media manipulation, a New York City financier and his firm, Medallion Financial Corp., have landed in legal hot water for an elaborate scheme involving planted online articles meant to influence investor sentiment. The U.S. Securities and Exchange Commission (SEC) has settled with the company and its president, Andrew Murstein, for a total of $4 million after a federal judge found credible evidence of deceptive tactics designed to inflate the company’s valuation during a challenging period marked by the meteoric rise of ride-hailing giants like Uber and Lyft.

A Modern Tale of Corporate Spin:

It was once a symbol of traditional New York success — the yellow taxi medallion, a gleaming license plate of prosperity. But in a changing transportation landscape dominated by app-based ride-hailing services, those medallions lost their luster. For Medallion Financial Corp., whose business revolved around financing these costly permits, the downturn was swift and brutal. And in a desperate bid to preserve shareholder confidence and company image, the firm’s leadership turned to an unconventional — and ultimately unlawful — solution: digital misinformation.

Andrew Murstein, president of the company, stands accused by the SEC of masterminding a covert campaign to sway public opinion and, by extension, Wall Street investors. According to court documents, Murstein hired media strategists to generate more than 50 flattering articles published on respected platforms like HuffPost and Crain’s New York Business, between 2014 and 2017. These articles were not ordinary press releases or transparently sponsored content. Instead, they were masked as genuine, independent analyses written by seemingly unbiased financial commentators.

Behind the scenes, however, the SEC alleges these “news” pieces were heavily edited — sometimes even written — by Murstein himself. They were designed not just to promote Medallion stock but to counter the souring sentiment caused by the disruptive wave brought on by Uber and Lyft, which significantly devalued the very assets Medallion was built upon.

From Valuation to Inflation:

Perhaps more troubling was the accusation of “opinion-shopping.” When one respected valuation firm refused to accept Medallion’s inflated figures amid a rapidly declining taxi industry, Murstein allegedly sought out a more agreeable consultant willing to paint a rosier financial picture. As a result, the perceived value of Medallion Bank’s portfolio leapt to $280 million by the end of 2016 — up from just $166 million two quarters earlier — even as the real-world value of taxi medallions was collapsing.

The SEC’s complaint, originally filed in December 2021, was part of an initiative under the agency’s chair, Gary Gensler, to pursue greater transparency in financial markets. U.S. District Judge Lewis A. Kaplan concluded that there was clear evidence Murstein and the company withheld material facts from investors. Though neither Murstein nor Medallion admitted to wrongdoing, they agreed to pay a combined $4 million to resolve the case.

Settling, But Not Forgetting:

The settlement includes a $3 million penalty from the company and a $1 million personal fine for Murstein. A separate $100,000 fine was levied against Lawrence Meyers, a California-based PR agent who worked closely with Murstein on the article campaign. The settlement, filed on May 29, was first reported by American Banker.

“Our agreement with the SEC puts this nearly decade-old matter behind us and enables us to apply our full focus to continuing to grow the company,” said a Medallion spokesperson. “It removes the distraction, cost, and uncertainty of continued litigation and is in the best interest of the company and our shareholders.”

But critics are skeptical. Some suggest that the SEC’s relatively moderate penalties could reflect changing enforcement priorities. “It does raise concerns if such tactics can be resolved with only monetary settlements,” said a source familiar with the investigation. Others argue the timing of the resolution — occurring after a change in SEC leadership — could indicate a push to clear inherited dockets from prior administrations.

A Legacy Tied to the Streets of New York:

Medallion Financial’s history is deeply entwined with the city’s taxi culture. Founded by Murstein’s father, Leon — a Polish immigrant and former cabbie — the company helped generations of drivers purchase medallions by financing up to two-thirds of the cost. At its peak, the value of a single medallion reached $1 million during the Bloomberg era. But as competition stiffened and demand plummeted, medallion values cratered, leaving many drivers saddled with debt and the company scrambling for footing.

Between 2002 and 2014, Murstein and his father reportedly earned over $42 million. Their spending extended beyond Wall Street; the firm once made headlines for its investments in NASCAR and professional lacrosse, and Murstein even booked rapper Nicki Minaj to perform at his son’s bar mitzvah in 2015 — a moment that gained viral notoriety.

Investor Confidence in a Post-Truth Era:

Medallion’s stock closed at $9.50 on Wednesday, seemingly stabilizing after years of volatility. Yet the episode raises serious questions about the influence of media manipulation in public markets and how companies can use online ecosystems to craft deceptive narratives.

As investors continue to digest the news and weigh the implications, the story of Medallion Financial serves as a cautionary tale — one where ambition, legacy, and the pursuit of image collided with federal securities law in the age of digital spin.

Appreciating your time:

We appreciate you taking the time to read our most recent article! We appreciate your opinions and would be delighted to hear them. We value your opinions as we work hard to make improvements and deliver material that you find interesting.

Post a Comment:

In the space provided for comments below, please share your ideas, opinions, and suggestions. We can better understand your interests thanks to your input, which also guarantees that the material we offer will appeal to you. Get in Direct Contact with Us: Please use our “Contact Us” form if you would like to speak with us or if you have any special questions. We are open to questions, collaborations, and, of course, criticism. To fill out our contact form, click this link.

Stay Connected:

Don’t miss out on future updates and articles.