BitMine Immersion Technologies has taken another bold step in its aggressive digital asset strategy, acquiring an additional 150,000 Ethereum (ETH). With this purchase, the company’s total holdings have reached nearly 1.87 million tokens, underscoring its stated goal of controlling 5% of Ethereum’s circulating supply.

This move positions BitMine not only as the largest listed ETH treasury firm but also as a company determined to define its role in the evolving landscape of corporate digital asset management.

Story Highlights

-

Massive Purchase: BitMine Immersion Technologies adds 150,000 ETH.

-

Total Holdings: Nearly 1.87 million Ethereum tokens.

-

Treasury Target: Aiming for 5% of Ethereum’s total supply.

-

Governance Update: David Sharbutt joins the board, adding seasoned oversight.

-

Risks: High exposure to Ethereum, share dilution, unprofitability, compliance concerns.

-

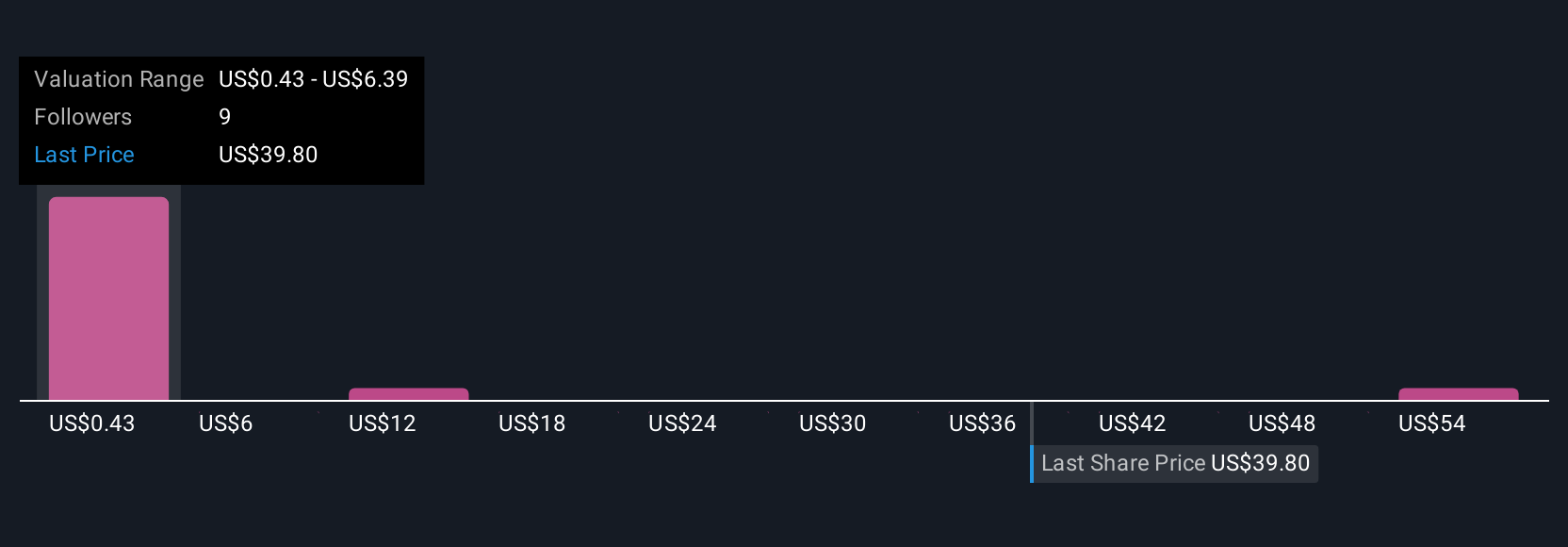

Market Sentiment: Wide gap in investor fair value estimates, from under US$1 to US$130.

Building an Ethereum Treasury

For BitMine Immersion Technologies, the bet is clear: Ethereum represents the future of digital finance, and building a corporate treasury around ETH could unlock long-term value. The company’s expanding holdings are meant to signal confidence not only in Ethereum itself but also in the role corporate treasuries can play in legitimizing digital assets.

“Being a shareholder in BitMine Immersion Technologies requires conviction in Ethereum’s future,” analysts note, “and faith that corporate treasury management can act as a gateway to wider adoption.”

Board Oversight and Institutional Signals

The appointment of David Sharbutt, a well-known industry veteran, to the board is seen as a governance milestone. His arrival comes at a time when BitMine is accelerating its accumulation strategy, and it could help address some investor concerns over oversight.

“Sharbutt’s presence on the board sends a signal to institutions that BitMine is serious about tightening its governance,” one market observer remarked. “But whether this is enough to shift investor confidence in the near term remains to be seen.”

Still, while the appointment may enhance oversight, the central story remains focused on the company’s Ethereum strategy and its ambitious treasury goals.

Risks Weighing on the Stock

Despite these developments, BitMine Immersion Technologies faces persistent challenges. Its reliance on a single digital asset exposes it to significant volatility. Share dilution continues to be a pressing concern for existing shareholders, and the company remains unprofitable.

“Governance improvements may help on the margins,” according to analysts, “but they do not erase the key risks of concentration, dilution, and compliance history.”

The company’s share price has been sliding, raising questions about whether it is moving into undervalued territory or reflecting deeper structural issues.

Investor Perspectives: A Divided Picture

Within the Simply Wall St Community, opinions on BitMine’s valuation vary widely. Fifteen individual investors have published fair value estimates ranging from under US$1 per share to as high as US$130.

This sharp divide underscores the uncertainty in the market. Some investors see BitMine as an undervalued play on Ethereum’s future. Others, however, remain skeptical, pointing to the company’s lack of profitability and history of compliance lapses.

“It’s rare to see such a wide gap in estimates,” one investor commented. “It shows just how polarizing BitMine Immersion Technologies has become in the digital asset space.”

Exploring Alternative Angles

For investors looking beyond BitMine, Simply Wall St highlights a range of fast-moving opportunities. These include companies with strong cash flow potential trading below fair value, AI firms developing early disease detection technologies, and U.S. energy companies set to benefit from policy changes.

Yet BitMine Immersion Technologies continues to capture attention, precisely because of its unusual scale in building an Ethereum treasury at a corporate level.

The Bigger Picture

Valuation of BitMine Immersion Technologies remains complex. While governance changes are notable, the core story continues to revolve around treasury growth, market accessibility after its NYSE American listing, and institutional demand for Ethereum.

For investors, the decision ultimately comes down to whether they believe BitMine’s conviction in Ethereum is visionary or too risky.

BitMine Immersion Technologies’ decision to expand its Ethereum treasury highlights both bold conviction and substantial risk. With nearly 1.87 million ETH secured and a target of holding 5% of the total supply, the company is betting heavily on digital assets becoming a cornerstone of corporate finance. The appointment of David Sharbutt signals an attempt to strengthen governance, but concerns over dilution, profitability, and compliance remain unresolved.

For investors, the story of BitMine Immersion Technologies is not simply about Ethereum’s price—it is about whether one company’s aggressive treasury strategy will define a new model for corporate digital asset management or expose the limits of concentration in a volatile market.

Appreciating your time:

We appreciate you taking the time to read our most recent article! We appreciate your opinions and would be delighted to hear them. We value your opinions as we work hard to make improvements and deliver material that you find interesting.

Post a Comment:

In the space provided for comments below, please share your ideas, opinions, and suggestions. We can better understand your interests thanks to your input, which also guarantees that the material we offer will appeal to you. Get in Direct Contact with Us: Please use our “Contact Us” form if you would like to speak with us or if you have any special questions. We are open to questions, collaborations, and, of course, criticism. To fill out our contact form, click this link.

Stay Connected:

Don’t miss out on future updates and articles.